Invest in high-yield real estate opportunities

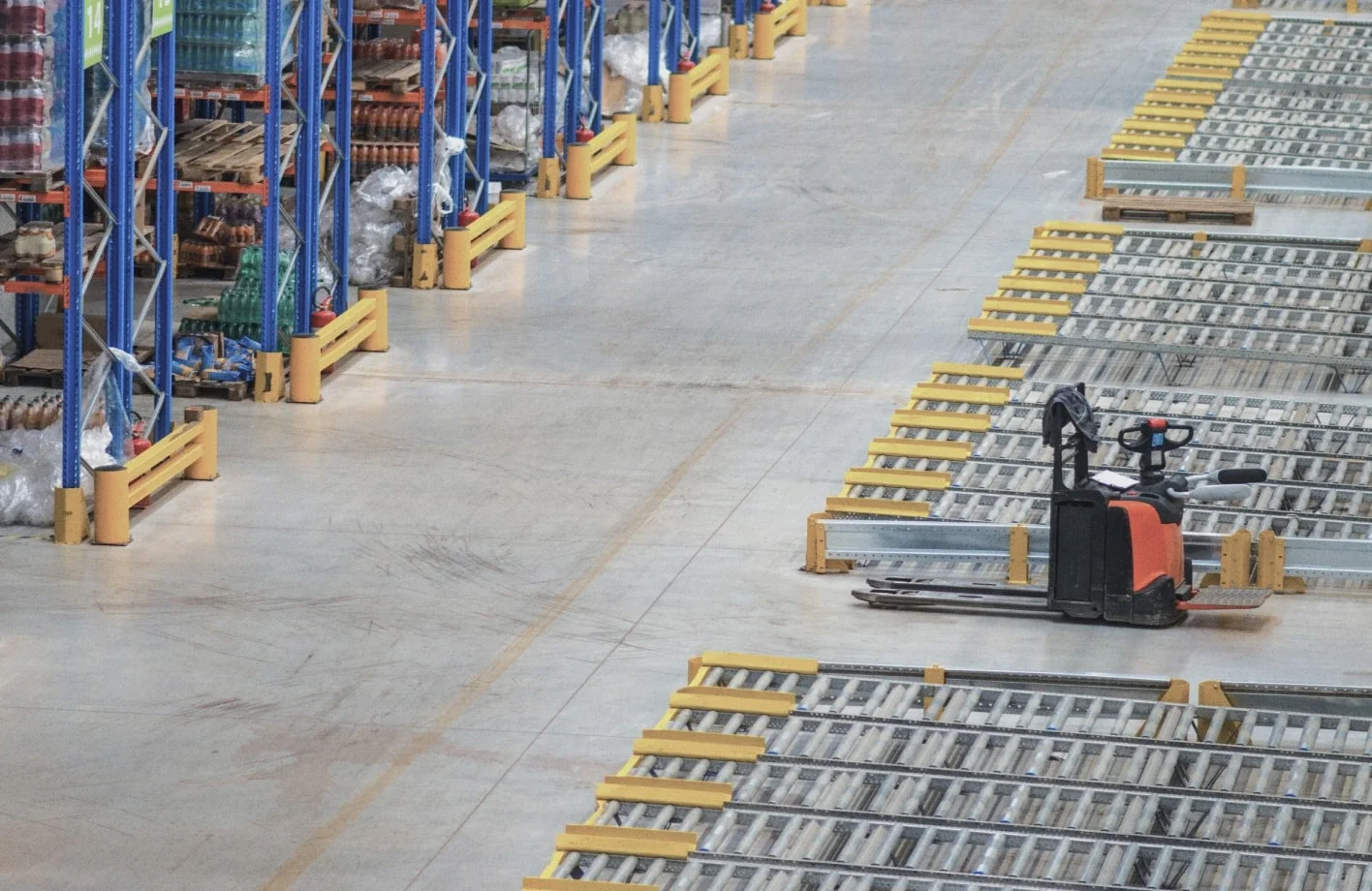

Our real estate investments are strategically focused on logistics assets like warehouses, vacation rentals, distribution centers, and high-yield properties such as data centers.

19.4 %

Historical returns

20 %

Maximum allocation

Our passive real estate investment strategy

Data center construction spending to hit $49 billion by 2030

Rising e-commerce sales lead to warehouse demand

Data centers rank as the top-performing real estate category

Data centers leased by tech giants like Google, Facebook, and Amazon offer long-term leases with 21% yields, surpassing other real estate assets. They also have the lowest rent default rates.