Invest in equipment leasing

Diversify your investment portfolio and secure steady returns by participating in equipment financing. We provide essential equipment and machinery leasing services to prominent corporations.

19.6 %

Historical returns

15 %

Maximum allocation

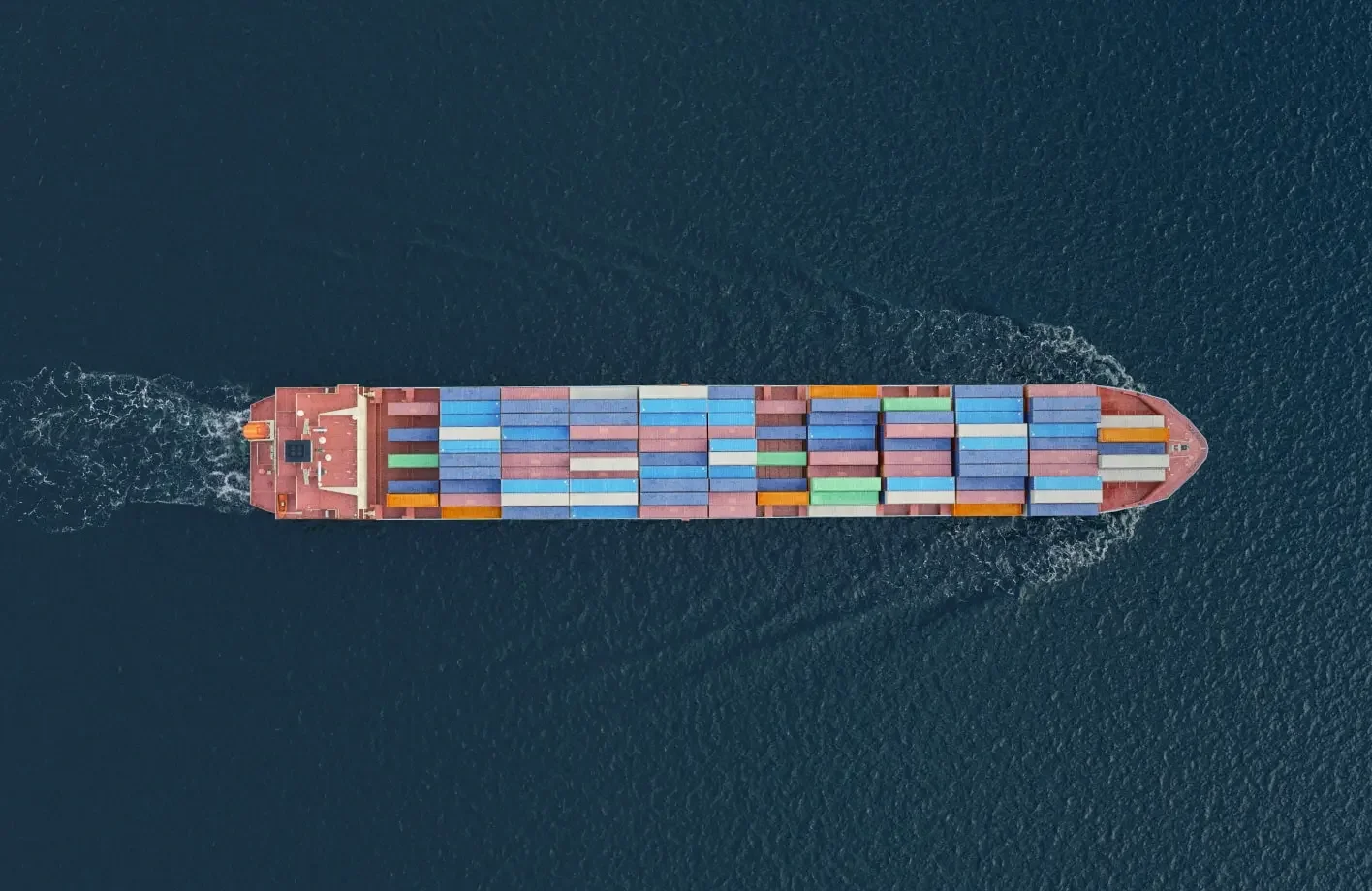

How equipment financing works

Large companies require machinery

Businesses prefer to lease

Flexible repayment plans for machinery finance

Equipment leasing industry market share analysis

Steady growth in equipment leasing

Equipment financing advantages

Predictable cash flow

Companies that lease assets such as equipment typically make monthly or quarterly payments, and around 40% of the total investment capital is recovered within the first year.

Secured with collateral

We enter into a Purchase Money Security Interest (PMSI) agreements where Hedonova retains ownership of the equipment. This makes recovery easier in case of defaults.

Low correlation

This industry is uncorrelated to financial markets. Payments from major corporations remain consistent even during periods of economic downturn, ensuring a steady revenue stream.

Tax benefits

The annual depreciation on the equipment is an expense that can be used to reduce the fund's taxability. Consequently, this leads to an increase in net returns.

Featured portfolio holdings

Invest in a diverse portfolio of alternative assets

Risk management

Liquidity

The leased equipment is typically tailored for specific companies, making it difficult to lease to another firm in the event of a default, leading to repossession.

Defaults

The companies that lease equipment may fail to make monthly lease payments. Security deposits typically cover one-time defaults.

Ownership

In some frontier markets, ownership laws can be ambiguous, especially concerning equipment held by special-purpose vehicles and owned by investors like Hedonova.

Equipment malfunctions

Equipment malfunctions usually need to be written off or replaced, which can incur significant costs. Most types of leased equipment are insured.